Moldova rental tax revenues jump 27% as landlord compliance improves

Moldova’s rental tax revenues saw a notable increase in 2025, driven by improved fiscal compliance and intensified enforcement. According to the State Tax Service (SFS), income tax collected from individuals leasing real estate rose by 27.2% between January and December 2025, reaching approximately €4.85 million (95.3 million MDL) compared to 2024.

The State Tax Service noted that 1,901 individuals leasing property were identified following voluntary compliance and information campaigns.

During the same period, tax authorities conducted 283 audits on individuals earning rental income. These inspections resulted in additional budget charges of over €33,200 (approx. 654,000 MDL) in principal payments, €3,250 (approx. 64,000 MDL) in late-payment penalties, and €1,830 (approx. 36,000 MDL) in fines.

Record number of registered contracts

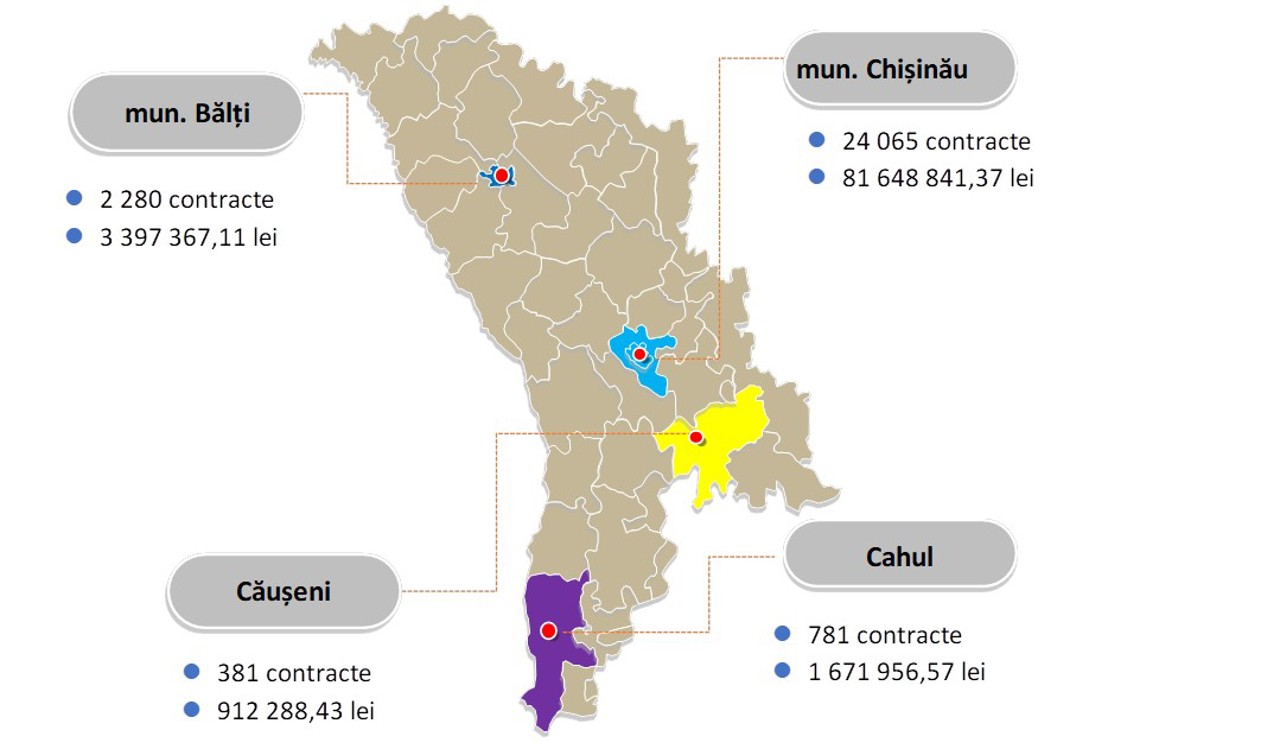

Official data also shows a significant rise in legal documentation. In 2025, 33,696 lease agreements were officially registered, representing a 29.2% increase compared to the previous year.

Tax authorities remind property owners that individuals not engaged in business activities who lease real estate are required to pay a 7% income tax on the monthly contract value. Under the Tax Code, lease agreements must be registered with the SFS within seven days of signing, and taxes must be paid monthly by the 25th.

These fiscal obligations also apply to property owners renting through online platforms, including Booking.com, Airbnb, and similar services.

Translation by Iurie Tataru