Moldova’s pharma sector eyes global expansion with €40 million investment

Moldova’s domestic pharmaceutical industry is undergoing a strategic shift toward international markets, with local producers now exporting over 70% of their output. Despite a small domestic market, the sector currently manufactures nearly 600 types of medicines, representing 10% of the products authorized in the National Drug Registry.

Gheorghe Apostol, President of the Association of Pharmaceutical Manufacturers, confirmed that Moldovan-made drugs now reach over 30 international markets. These include the European Union, the CIS region, the Middle East, North Africa, and parts of Southeast Asia.

Integration into European standards

The industry’s expansion is underpinned by strict adherence to Good Manufacturing Practice (GMP) standards. Several Moldovan facilities have already secured certification from EU regulatory bodies. As of 2024, locally manufactured injectable medicines are being delivered directly to EU member states.

"Technically, the industry is already integrated into the European regulatory space," Apostol stated, noting that large-scale industrial production would not be commercially viable without this external access.

Investment and unused potential

To capitalize on this momentum, the sector is preparing investments exceeding €40 million (approx. 788 million MDL). These projects follow a long-term industrial cycle, with results expected to materialize within the next 18 to 24 months.

Currently, local production facilities operate at less than 50% of their installed capacity. Industry leaders view this as a strategic advantage for foreign investors seeking contract manufacturing partnerships in a region where pharmaceutical supply chains are under increasing pressure.

Market challenges and pricing risks

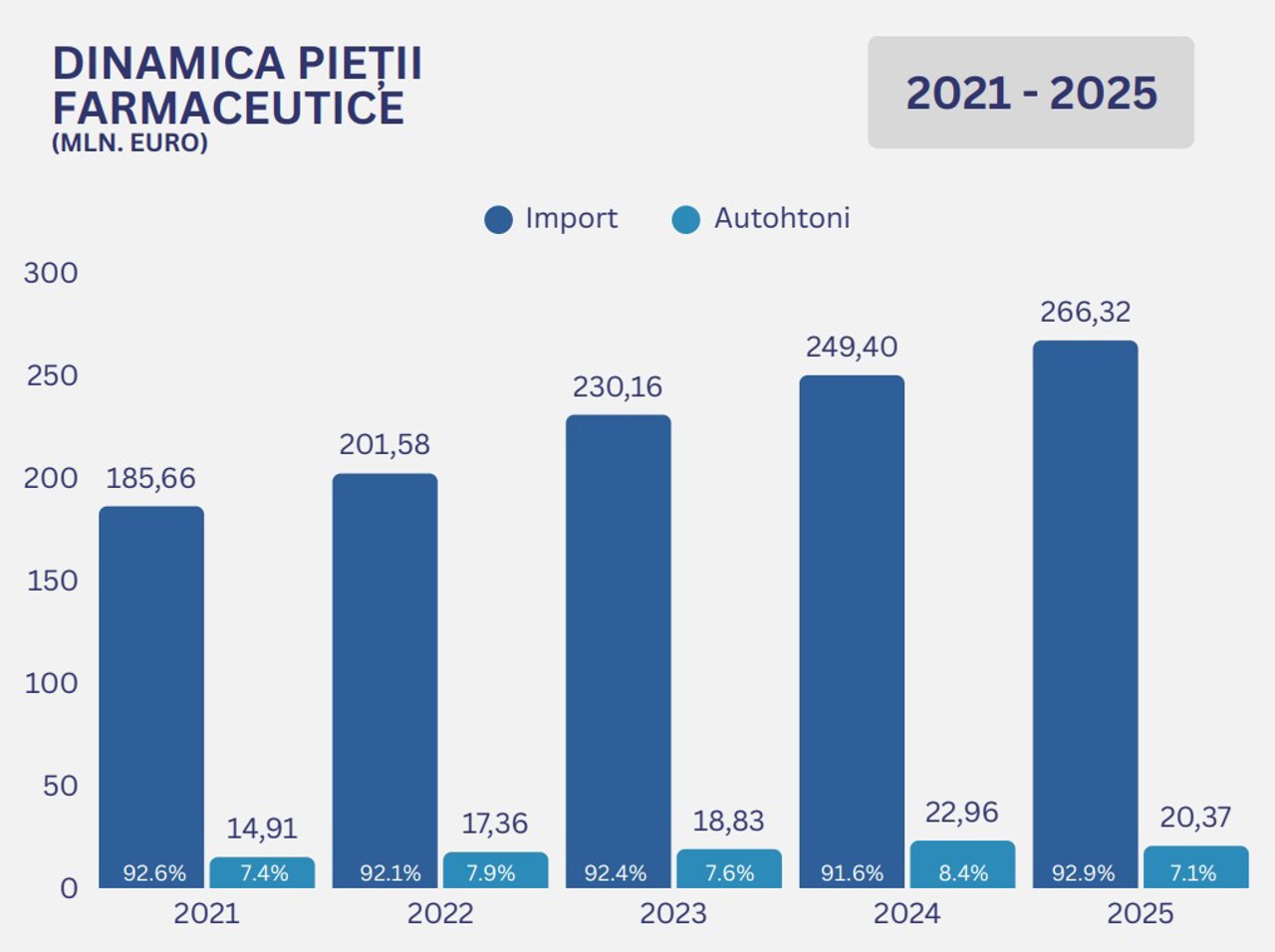

While production grows, the domestic market remains dominated by imports, which accounted for 92.89% of the €866.7 million (approx. 17.07 billion MDL) total market value in 2025. Local manufacturers provide 13.8% of the market volume but only 7.1% of its value, highlighting the affordability of domestic drugs.

However, strict price caps are causing friction. Apostol warned that when prices are set based on market averages rather than real production costs, manufacturers face a stark choice. "The primary risk is not rising prices, but the complete disappearance of essential medicines from the market," he cautioned.

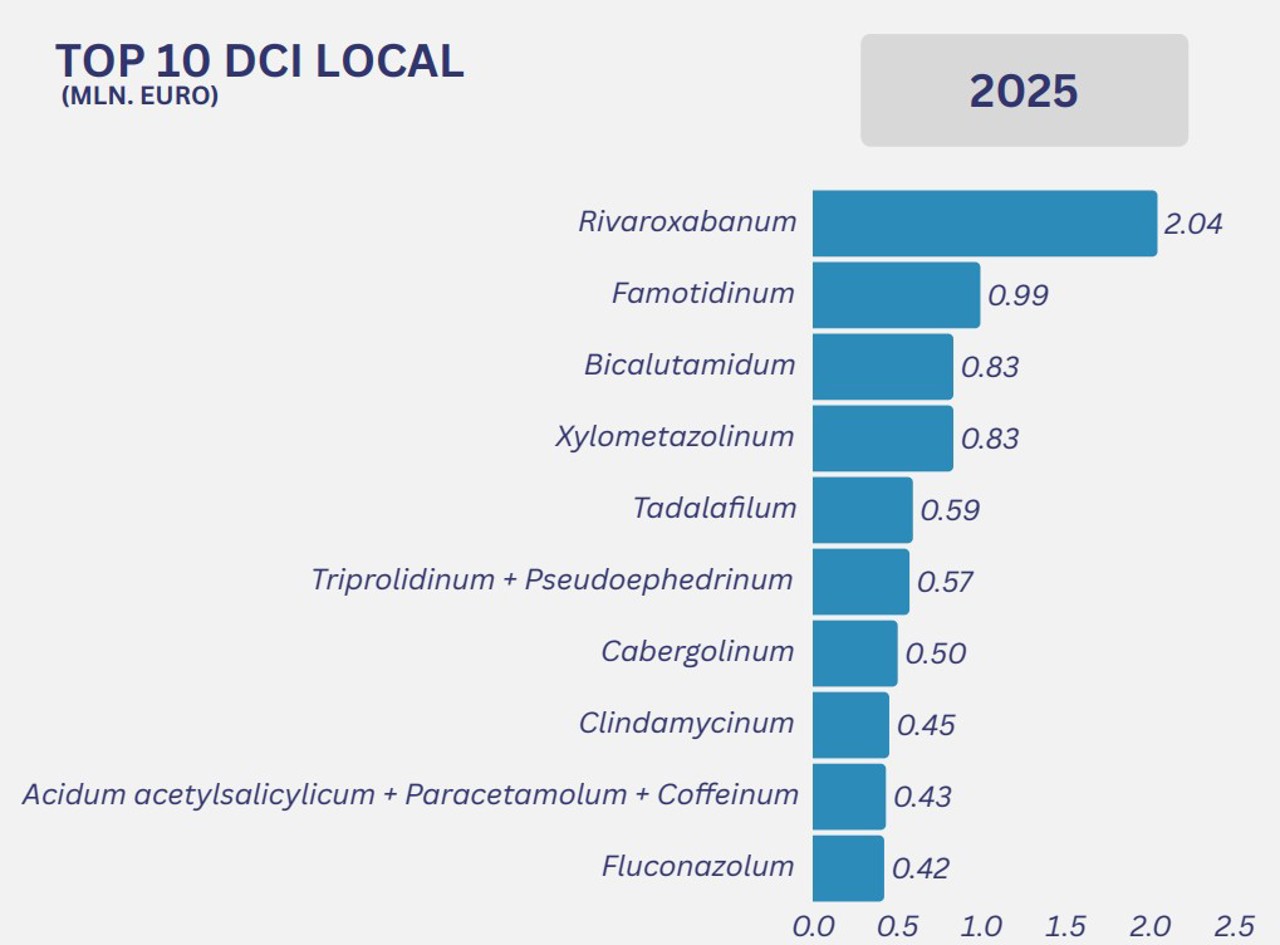

Top-selling domestic medicines

The most successful products manufactured in Moldova include Rivaroxabanum (anticoagulant), Famotidinum (gastrointestinal treatment), and Bicalutamidum (oncology). In contrast, the import market is led by treatments for Type 2 diabetes and pain management.

Translation by Iurie Tataru