Infographic // Moldova: First Home Program Expands Eligibility

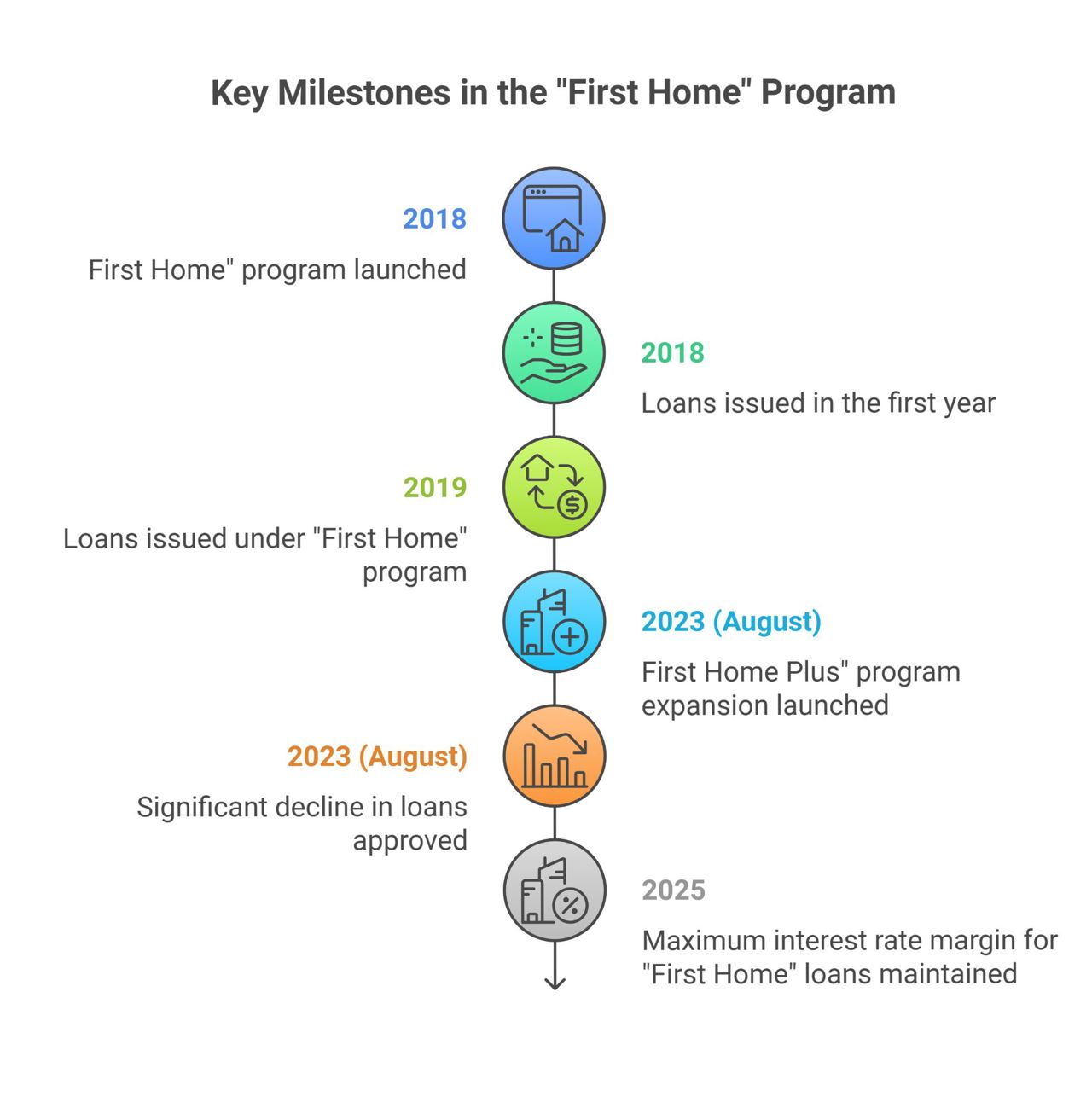

The maximum interest rate margin that banks can apply to government-guaranteed loans under the "First Home" program in 2025 will remain at 3%.

The draft government decree has been approved by the Executive. This margin will enable banks to cover the costs associated with the loan, ensuring the continued operation of the program and the availability of 30-year mortgages.

Notably, starting this year, the program's eligibility criteria have been broadened, removing the requirement for applicants to be employed in the Republic of Moldova. Consequently, individuals who are not employed, including freelancers, lawyers, bailiffs, mediators, taxi drivers, and artists, as well as individuals residing abroad with official income sources in Moldova, are now eligible to apply.

As a reminder, the government's "First Home" program was launched in March 2018. Over 8,000 individuals have successfully acquired housing through the program, including over 5,600 families and approximately 2,500 unmarried young people.

In the first year, the "First Home" program issued approximately 1,200 loans, and in 2019, over 2,700 loans were granted. The program witnessed a significant decline in its uptake in 2023, with only 60 loans approved.

Subsequently, in August of this year, the program was expanded to "First Home Plus," enabling access to increased financing for home purchases. Within three months of the launch of the government's "First Home Plus" program, over a thousand families have purchased new homes. The prices of these homes range from 400,000 to 2.5 million lei. Approximately one in nine beneficiaries chose to purchase homes in urban areas, while the remaining beneficiaries opted for rural areas.

Translation by Iurie Tataru