Moldova's recovery: World Bank sees 3.8% growth by 2027

The Republic of Moldova’s economy is showing signs of a rebound after two years of external shocks and high inflation, yet persistent structural imbalances and external vulnerabilities remain a concern.

According to the World Bank Report—the Moldova Economic Update – Fall 2025—presented on November 4 in Chișinău, economic growth was muted in the first half of the year, but a steady acceleration is anticipated from 2026 to 2027.

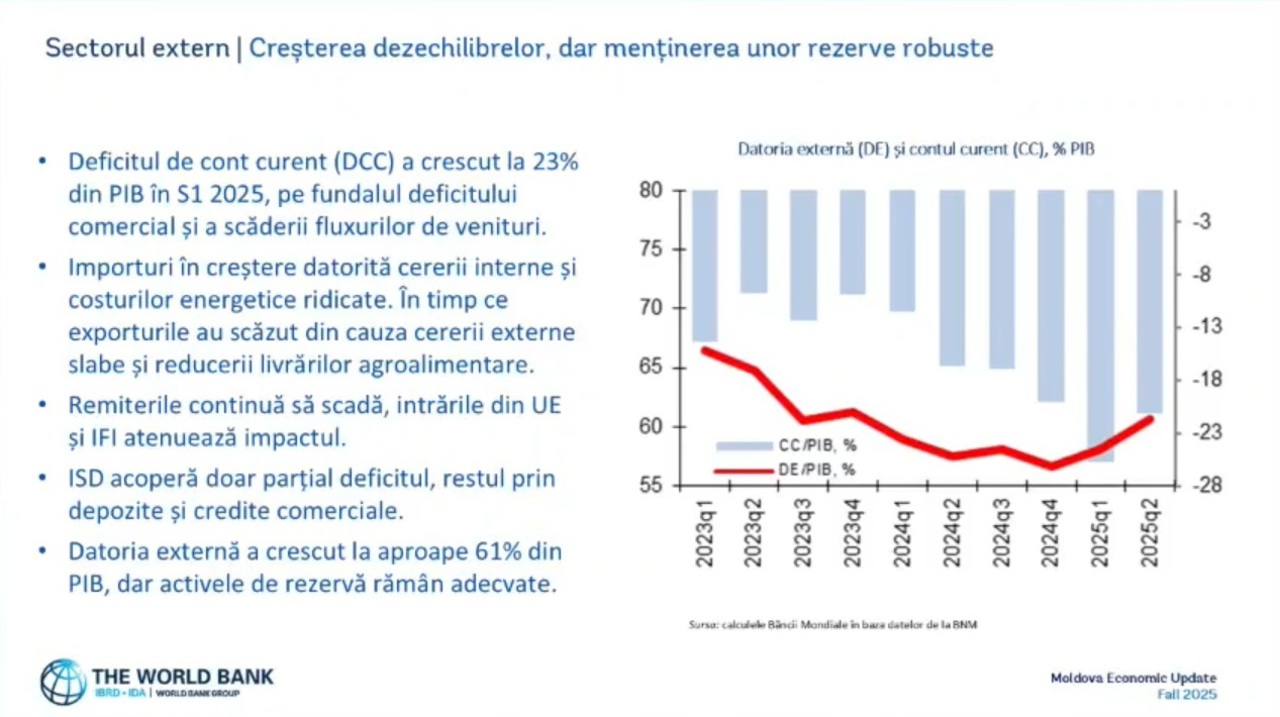

Following H1 stagnation, the economy gained momentum, fueled primarily by a surge in investments. Despite this, external headwinds and a significantly high Current Account Deficit—registering approximately 23% of GDP in the first semester—continue to place considerable pressure on the economy.

Over the medium term, World Bank experts project brighter prospects. They anticipate economic growth will accelerate, driven by productivity gains resulting from reforms and deeper EU Integration into the European single market.

"The current political environment, characterized by continuity, presents a unique window of opportunity to accelerate reforms. Aligning with the EU accession agenda and accessing mechanisms like the Growth Plan unlocks substantial resources for the development of the Republic of Moldova. The World Bank Group stands ready to support the Government in maximizing the absorption of these funds and translating reforms into tangible benefits for its citizens," stated Ulrich Schmidt, World Bank Group Country Manager for Moldova, at the report launch.

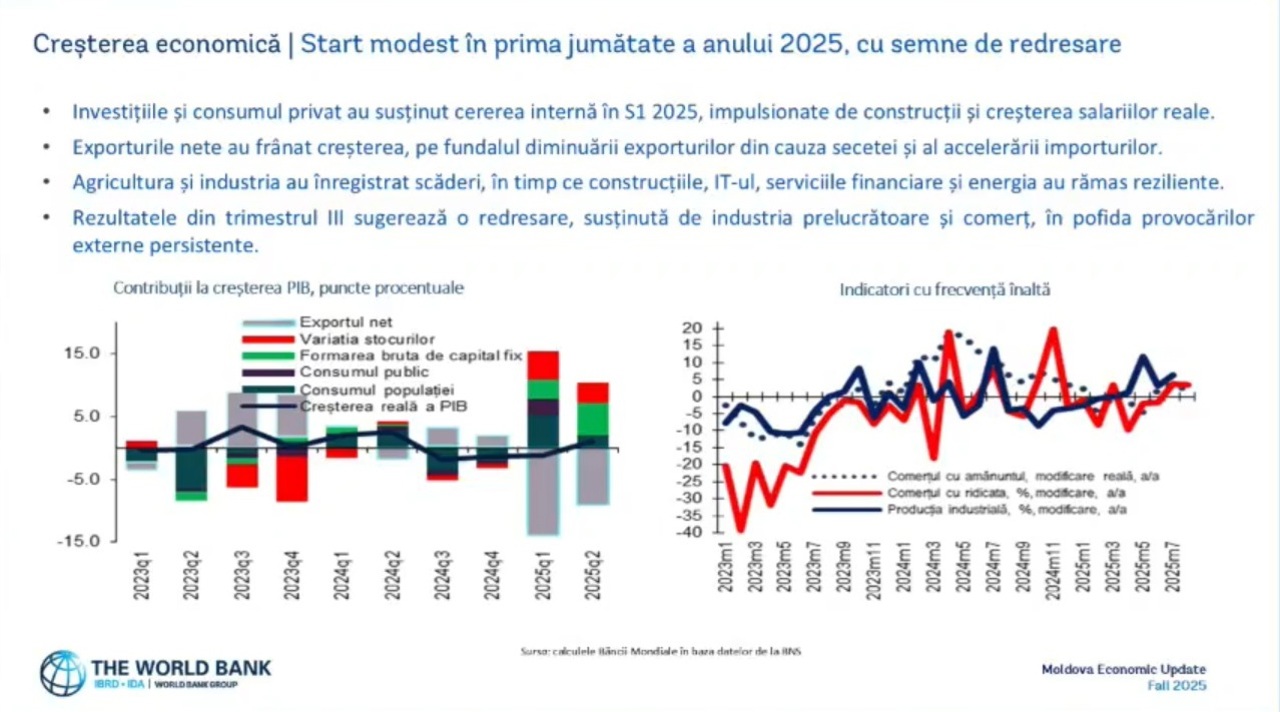

Modest growth anchored by investment and domestic consumption

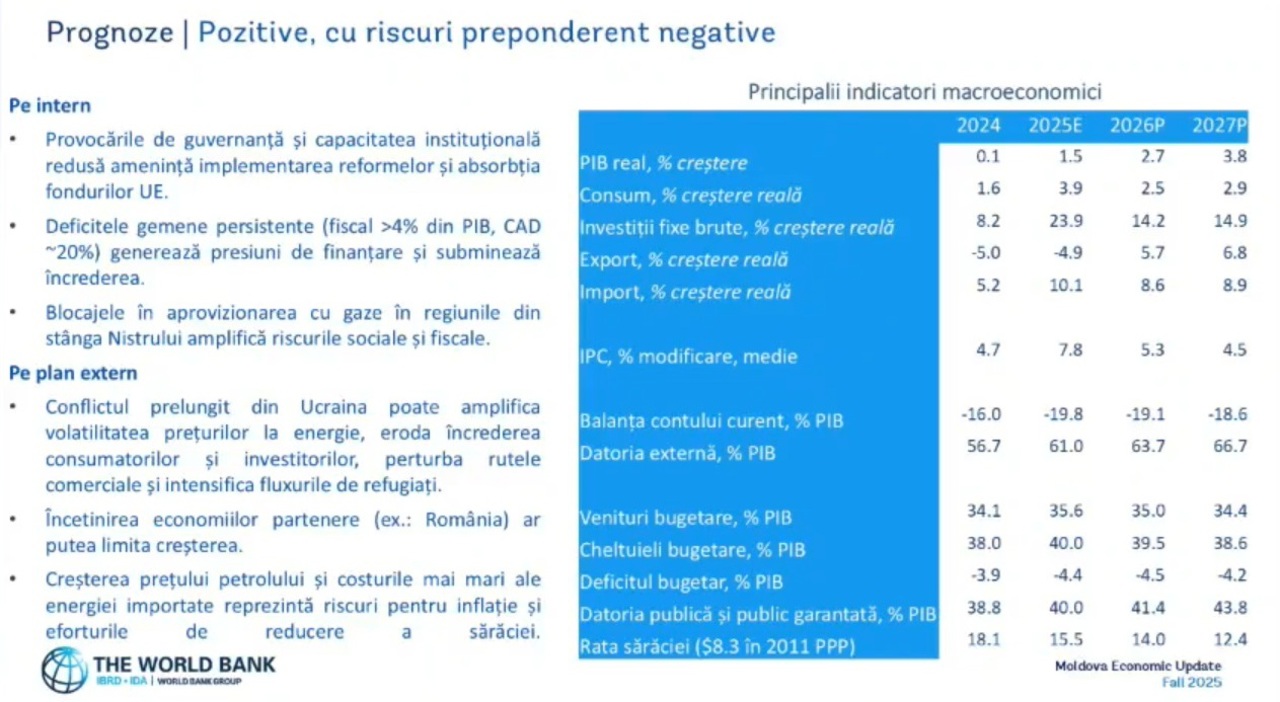

The World Bank forecasts GDP growth of 1.5% in 2025, which is projected to climb to 2.7% in 2026 and 3.8% in 2027. This recovery is underpinned by construction investments and rising real wages, even as exports are constrained by drought and weaker external demand.

"While investments and private consumption buoyed domestic demand, net exports acted as a drag on growth," the document notes. Furthermore, while agriculture and industry experienced downturns, the IT, financial services, and energy sectors exhibited continued resilience.

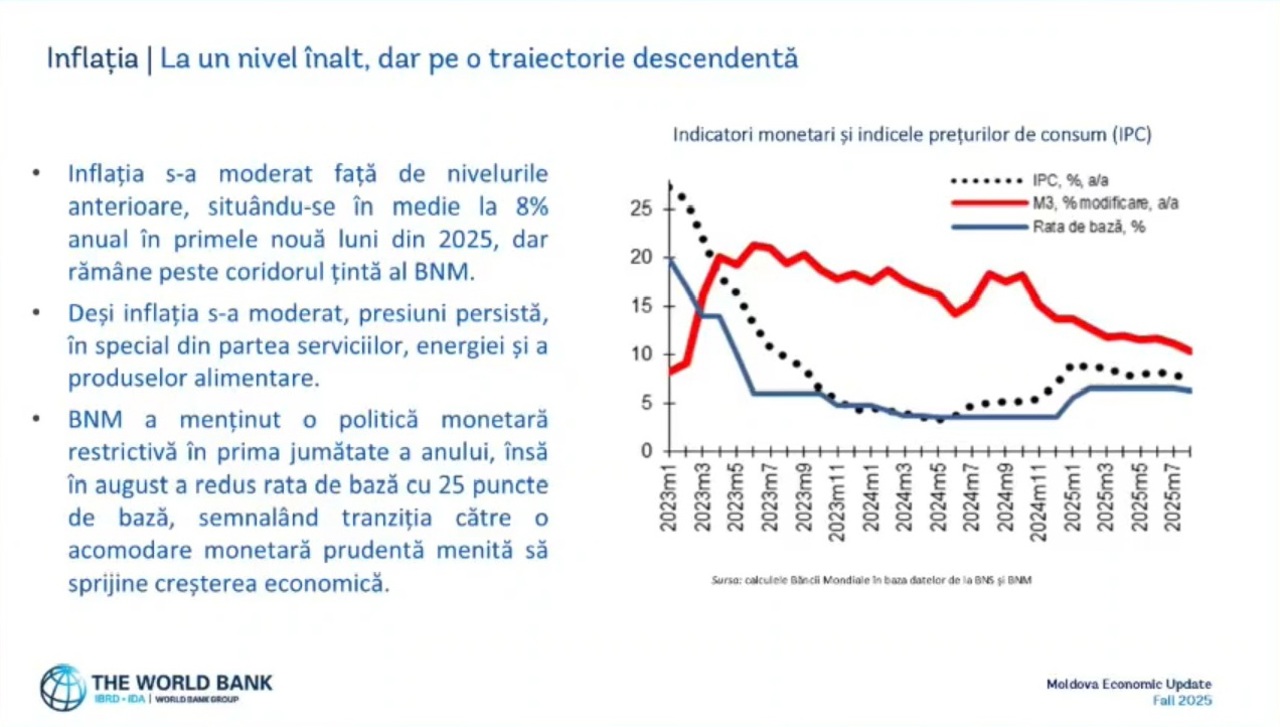

Inflation moderates but exceeds NBM target

Annual inflation saw a decline to approximately 8% in the first nine months of 2025, a significant reduction from previous years. However, it still registers above the target band set by the National Bank of Moldova (NBM). Price pressures are primarily driven by elevated costs for energy, services, and food.

The National Bank maintained a restrictive monetary policy during the first half of the year, although it reduced the base rate by 25 basis points in August to stimulate economic growth and prevent credit overheating.

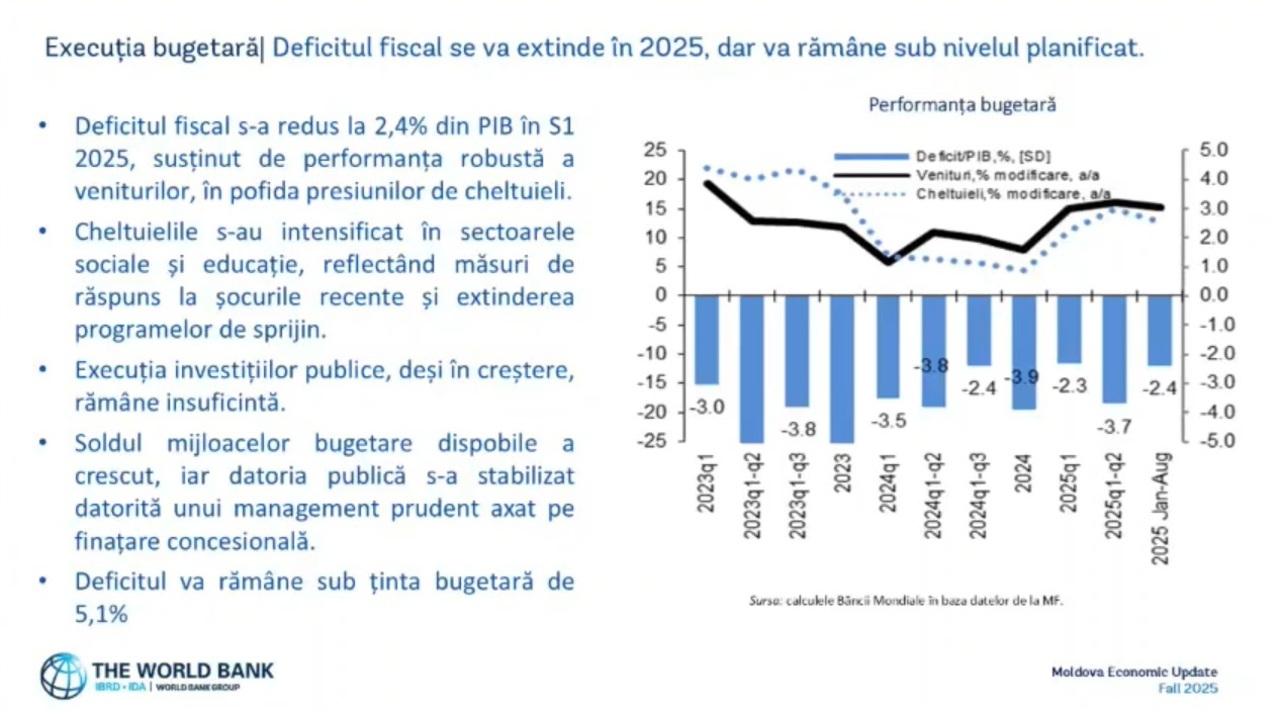

Fiscal deficit: Contained, yet facing social headwinds

The fiscal deficit narrowed to 2.4% of GDP in the first half of the year, thanks to robust budget revenues. Nevertheless, social and educational expenditures remain substantial. The deficit is estimated to stabilize above 4% of GDP in the medium term, with public and publicly guaranteed debt expected to surpass 50% of GDP by 2027.

"While the economy is recovering, external challenges and the twin deficits—fiscal and current account—remain key risks. Over the medium term, we see potential for growth rooted in investment and improved productivity, but this hinges critically on the pace of reforms. Net exports are expected to contribute more positively as the economy deepens its integration with the European market," explained Marcel Chistruga, the World Bank's Senior Economist for Moldova.

The report emphasizes that "financing pressures generated by the twin deficits—fiscal and current account—undermine confidence and restrict the authorities' fiscal maneuvering room."

External imbalances worsen

The Current Account Deficit escalated to 23% of GDP in H1 2025. This was primarily attributed to soaring energy import costs and a contraction in agri-food exports.

External debt is nearing 61% of GDP, though foreign exchange reserves are assessed as adequate.

Inflows from the European Union and International Financial Institutions (IFIs) are helping to offset the negative impact of diminishing remittances, particularly from CIS countries.

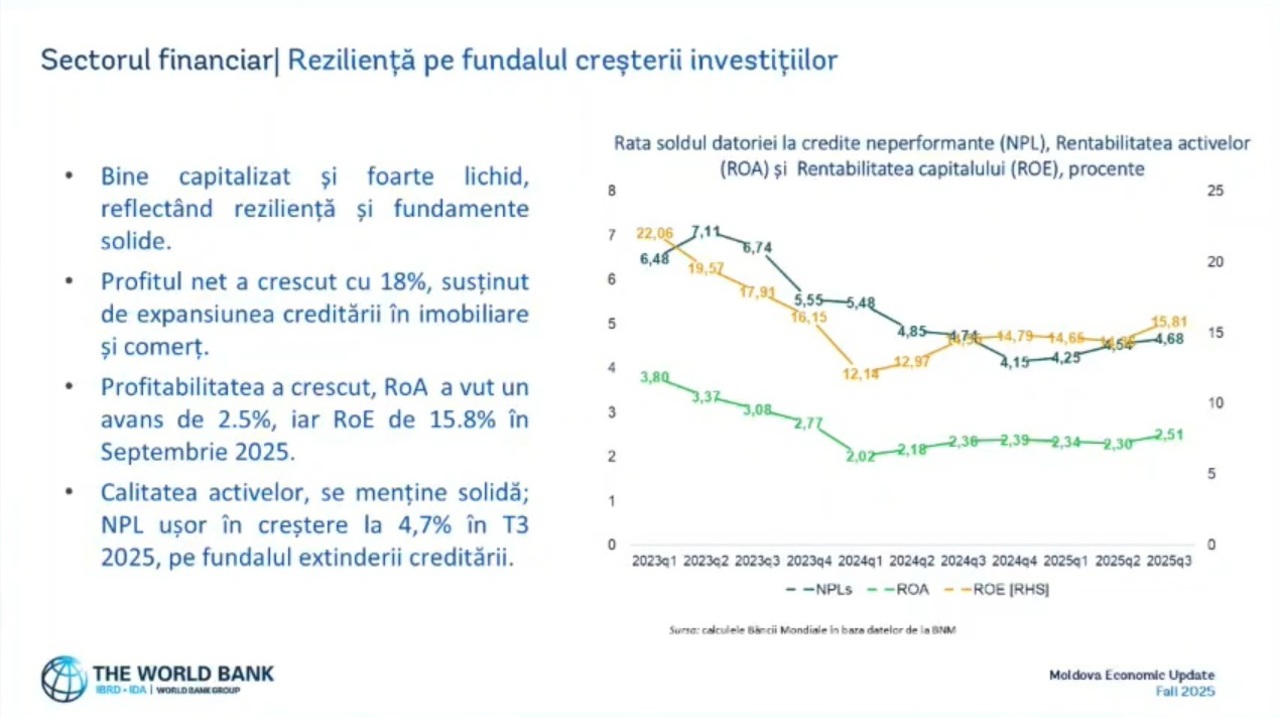

Financial sector: Stable and profitable

The Moldovan banking system is characterized by the World Bank as "well-capitalized and highly liquid."

Net profit surged by 18%, underpinned by credit expansion in the real estate and commercial sectors.

Return on Equity (RoE) reached 15.8%, and asset quality remains robust, evidenced by a non-performing loan (NPL) rate of 4.7%.

Positive forecasts shadowed by predominantly downside risks

World Bank experts highlight that governance challenges and limited institutional capacity could hinder the implementation of reforms and the absorption of European funds.

Furthermore, the protracted conflict in Ukraine and the volatility of energy prices persist as the principal external risks to the Moldovan economy.

The World Bank cautions that "a slowdown in partner economies, particularly Romania, could constrain Moldovan exports," while rising fuel costs risk escalating inflationary pressures and the poverty rate.

2026–2027 Outlook: Backed by European Union support

For the medium term, the World Bank anticipates a gradual strengthening of economic growth, driven by better external conditions, investments in agriculture and infrastructure, and the utilization of funds from the European Union's Reform and Growth Mechanism.

The poverty rate is projected to continue its decline, from 18.1% in 2024 to 15.6% in 2027. However, the speed of this reduction is contingent upon the execution of structural reforms and price stability.

The World Bank Group is a foremost source of financing and expertise for developing nations, comprising five institutions dedicated to reducing poverty, boosting shared prosperity, and fostering sustainable development.

In the Republic of Moldova, the World Bank Group supports the country's development agenda through project financing, policy dialogue, and technical assistance.

Translation by Iurie Tataru